Member Profile

LV Trading Diary  |

| Total Cumulative Posts |

185 |

| Joined |

Apr 2023 |

Blogs

| Blog Title | Total Posts | Last Published |

| LV 股票分享站 | 151 | 22 May 2025 |

Comments

| | User Comments |

|  31 May 2023, 9:43:38 AM 31 May 2023, 9:43:38 AM

Since the successful acquisition of Supercomal Medical Products Sdn Bhd (SMP) in October 2017, Supercomnet Technologies Berhad (SCOMNET, 0001) has consistently shown a trend of continuous growth in its performance, even reaching new highs in the third quarter of the 2022 fiscal year.

Before delving into the latest performance released by SCOMNET a few days ago, let's briefly comprehend the background of the company. According to the company's official website, SCOMNET was established on May 10, 1990, and listed on the Malaysian Stock Exchange's ACE Market on April 30, 1999. The company's primary business includes the manufacturing and assembly of medical devices, electrical appliances, consumer electronic products, and automotive wires and cables.

The business is operated by three wholly-owned subsidiaries under SCOMNET. The first subsidiary is Supercomnet Technologies Berhad (STB), responsible for producing various custom cables and wire products for original equipment manufacturers in the automotive, electrical, and other industries. The second subsidiary is Supercomal Advanced Cables Sdn Bhd (SAC), primarily involved in the manufacturing and assembly of fuel tanks, wires, and cables for the automotive industry. The last one is SMP, as mentioned earlier, which is responsible for the manufacturing and assembly of medical-related cables and equipment.

According to the 2022 annual report, the main source of SCOMNET's revenue comes from SMP's business, accounting for approximately 62.00% of the total revenue for the 2022 fiscal year. This is followed by the businesses of STB and SAC, accounting for approximately 28.00% and 10.00% of the total revenue, respectively.

Although SCOMNET has a wide range of customers worldwide, Malaysia remains the company's primary market, representing around 61.62% of its revenue for the 2022 fiscal year. The Dominican Republic (24.52%), the United States (9.05%), Denmark (2.63%), Singapore (2.90%), and Taiwan (0.09%) are the next significant markets.

For information, most of SCOMNET's cable products related to automotive and consumer appliances are sold to Malaysian customers, while medical-related cables and pipeline products are primarily exported overseas.

Now, let's explore the performance of SCOMNET's latest quarterly results (Q1FY2023).

Revenue Comparison (YoY +3.89%, QoQ +0.05%)

For the first quarter ending March 31, 2023, the company's revenue was approximately RM37.37 million, showing a year-on-year growth of about 3.89% and a quarter-on-quarter growth of 0.05%. This is mainly attributed to increased revenue contribution from the automotive sector.

According to research, the revenue from the automotive sector benefited from supplying wire and fuel tanks for the Peugeot 2008, 3008, and 5008 models to Stellantis.

Net Profit Comparison (YoY -5.13%, QoQ +15.27%)

Due to the soft contribution from the medical sector in this quarter caused by a decline in demand for endoscopy video cables used in the treatment of COVID-19, the company's net profit decreased by approximately RM0.38 million or 5.13% year-on-year, to around RM7.02 million. Additionally, increased labor costs and electricity prices also affected the company's profitability.

However, compared to the previous quarter, the net profit increased by approximately RM0.93 million or 15.27%. This increase was driven by higher sales of medical-related products with higher profit margins. Therefore, the company's profit margin for this quarter improved from 16.30% in the previous quarter to approximately 18.79%.

It is worth mentioning that SCOMNET also announced the distribution of a final dividend of RM 0.0150 during this quarter, with an ex-dividend date of June 22 and payment date on July 18, 2023.

Outlook

The company is currently undergoing factory expansion plans, with a planned capital expenditure of approximately RM25.00 million over the next three years to construct a new five-story facility for the production of new medical products. Once completed, the company is expected to add 12,000 square meters of production capacity.

Meanwhile, the company has submitted an application to transfer to the Main Market to institutions such as the Malaysian Investment Development Authority (MIDA) and the Ministry of International Trade and Industry (MITI). Therefore, SCOMNET is expected to transfer to the Main Market within this year.

So, how do readers view SCOMNET, which currently has a price-to-earnings ratio of approximately 31.23 times?

|

|  31 May 2023, 12:04:05 AM 31 May 2023, 12:04:05 AM

自2017年10月成功收购Supercomal Medical Products Sdn Bhd(SMP)以来,Supercomnet Technologies Berhad(SCOMNET、0001)的业绩一直呈现出持续增长趋势,并在2022财年第三季度创下新高。

在深入探讨SCOMNET昨日所发布的最新业绩之前,先简要介绍一下该公司的背景。

从公司官网来看,SCOMNET成立于1990年5月10日,并于1999年4月30日在马来西亚交易所的创业板上市。该公司的主要业务包括医疗设备、电器、消费电子产品和汽车电线与电缆的制造和组装。

其业务由SCOMNET旗下的三家全资子公司运营。第一家是Supercomnet Technologies Berhad(STB),负责为汽车、电器和其他领域的原始设备制造商生产各种定制电缆和电线产品。第二家子公司是Supercomal Advanced Cables Sdn Bhd(SAC),主要为汽车行业制造和组装油箱、电线和电缆。最后一家就是之前提到的SMP,该子公司负责制造和组装医疗相关的电缆和设备。

根据2022年年报,SCOMNET的主要收入来源于SMP的业务,占2022财年总总收入的62.00%。其次是STB和SAC的业务,分别占据总收入的28.00%和10.00%左右。

尽管SCOMNET的客户广泛,遍布四方各地,但马来西亚仍是公司的主要市场,占其2022财年营业额的61.62%左右。接下来便是多米尼加共和国(24.52%)、美国(9.05%)、丹麦(2.63%)、新加坡(2.90%)和台湾(0.09%)。

据了解,SCOMNET大部分与汽车和消费家电相关的电缆产品都销售给马来西亚客户,而医疗相关的电缆和管线产品则主要销往海外。

接下来,就来探讨SCOMNET最新季度业绩(Q1FY2023)的表现吧。

营业额比较(YoY +3.89%、QoQ +0.05%)

截至2023年3月31日的第一季度,公司的营业收入约为RM37.37 million,同比和环比分别增长约3.89%和 0.05%。这主要是由于汽车领域的收入贡献增加。

据调查,汽车领域的收入受益于为Stellantis提供Peugeot 2008、3008和5008车型的电线和燃油箱。

税后盈利比较(YoY -5.13%、QoQ +15.27%)

由于对用于治疗新冠肺炎(“COVID-19”)的内窥镜视频电缆(“Endoscopy Video Cables”)的需求下降,医疗领域在本季度的贡献出现疲软。因此,公司的净利润同比减少了约RM0.38 million或5.13%,至RM7.02 million左右。此外,劳动成本和电价的上涨也影响公司的盈利能力。

不过,与上一季度对比,公司的净利润增加了约RM0.93 million或15.27%。这是由于利润率较高的医疗相关产品的销售额增加。因此,公司本季的利润率从上一季的16.30%提高至18.79%左右。

值得一提的是,SCOMNET也在本季度中宣布派发 RM 0.0150 的末期股息,除权日于 6 月 22日,将于 2023 年 7月 18 日支付。

前景展望

公司的工厂扩建正在进行中,计划在未来三年内投入约RM25.00 million的资本支出,用于兴建一座新的五层厂房,以生产新的医疗产品。项目建成后,公司预计将增加12, 000平方米的生产能力。

与此同时,公司已向大马投资发展局 (“MIDA”)和国际贸易与工业部 (“MITI”)等机构提交转至主板的申请。因此,SCOMNET有望在今年内转至主板。

最后,各位读者是如何看待当前市盈率为31.23倍左右的SCOMNET呢?

|

|  30 May 2023, 9:13:53 AM 30 May 2023, 9:13:53 AM

Following the outstanding performance of DPHARMA (7148), another company has recently announced remarkable results, and that is Uchi Technologies Berhad (UCHITEC, 7100). The company achieved record-breaking revenue and profit in the first quarter.

First, let’s briefly comprehend the company’s background. UCHITEC is an electronic assembly company which headquartered in Penang. It specializes in providing end-to-end services for the design, research and development, and manufacturing of electronic control systems. This business is commonly known as “original design manufacturing” (ODM).

The company's business is operated by its three wholly-owned subsidiaries: Uchi Technologies (Dongguan) Co., LTD, Uchi Optoelectronic (M) Sdn Bhd, and Uchi Electronic (M) Sdn Bhd. According to the company's annual report, Uchi Optoelectronic (M) Sdn Bhd is responsible for the design, research and development, and manufacturing of electronic control modules, while Uchi Electronic (M) Sdn Bhd and Uchi Technologies (Dongguan) Co., LTD handle electronic assembly.

UCHITEC's designed and manufactured products are primarily used in household goods and biotechnology products. In the household goods segment, the main contribution to the company's revenue comes from fully automated coffee machines, accounting for approximately 88.0% of the total revenue in the fiscal year 2022.

Additionally, the company's biotechnology-related products, such as high-precision weighing scales, centrifuges, and deep freezers, contributed approximately 11.0% to the revenue in the fiscal year 2022.

According to the 2022 annual report, more than 97.0% of the company's products are exported to the European market, including Switzerland (45.0%), Portugal (43.0%), Germany (7.0%), and the United Kingdom (2.0%). The remaining markets include the United States (1.0%), China (1.0%), and other countries (1.0%).

For information, UCHITEC's largest customer is JURA, a coffee machine manufacturer based in Switzerland, which contributed approximately 92.3% to the company's total revenue in the fiscal year 2022.

Now, let's take a look at the performance of UCHITEC in the latest quarterly report (Q1FY2023).

Revenue Comparison (YoY +19.79%, QoQ +5.24%)

As of March 31, 2023, the company's revenue was approximately RM57.43 million, an increase of approximately RM9.49 million or 19.79% compared to the same period last year, which was around RM47.94 million. This growth is mainly due to increased demand for the company's products and services.

Out of this, around RM51.77 million of revenue came from household goods, showing a year-on-year growth of approximately 22.86%. However, the revenue from biotechnology products decreased by around 2.58% to RM5.65 million.

In terms of geographical distribution, market revenues in Europe, Asia, and the United States increased by approximately 18.42%, 122.78%, and 35.94% year-on-year, reaching RM55.57 million, RM1.23 million, and RM0.62 million, respectively.

Compared to the previous quarter, the company's revenue increased by approximately RM2.86 million or 5.24%.

Net Profit Comparison (YoY +41.20%, QoQ +15.63%)

Driven by strong demand for products and services, the company achieved a net profit of approximately RM37.80 million, representing a year-on-year and quarter-on-quarter growth of approximately 41.20% and 15.63%, respectively.

In fact, the company had a gain from the disposal of held-for-sale assets in this quarter, totaling approximately RM11.30 million. Therefore, after adjustment, the core net profit of the company is approximately RM26.50 million.

It is worth mentioning that Uchi Optoelectronic (M) Sdn Bhd, a subsidiary of the company, obtained a 5-year tax exemption from the Ministry of International Trade and Industry (MITI) on January 9th this year, which undoubtedly benefits the company's future profit.

Outlook

Management expects no significant changes in the geographical distribution and product revenue contributions. Factors that may affect UCHITEC's performance include fluctuations in USD exchange rates, material shortages, fluctuations in material prices, and labor supply shortages. Nevertheless, management is confident in maintaining the company's profitability and healthy balance sheet.

In summary, UCHITEC is one of the few companies that maintains a high profit margin and has no debt with a strong cash position. Additionally, the dividend payout ratio of the company is relatively high, averaging above 90.0%.

So, what are your thoughts on UCHITEC, with a current price-to-earnings (P/E) ratio of approximately 11.13 times?

|

|  29 May 2023, 3:55:15 PM 29 May 2023, 3:55:15 PM

继DPHARMA(7148)之后,日前又有一家公司公布了非常卓越的业绩,那就是Uchi Technologies Berhad(UCHITEC、7100)。该公司首季的营业额及盈利也创下季度新高。

先简单介绍UCHITEC这家公司。UCHITEC 是一家电子组装公司,总部位于槟城。该公司专门提供电子控制系统(“Electronic Control System”)设计、研发以及制造的一站式服务,俗称原设计制造(“Original Design Manufacturing”或“ODM”)。

公司业务由其三家全资子公司来营运,分别是Uchi Technologies (Dongguan) Co., LTD、Uchi Optoelectronic (M) Sdn Bhd 和Uchi Electronic (M) Sdn Bhd。根据公司年报,Uchi Optoelectronic (M) Sdn Bhd负责电子控制模组的设计、研发和制造;Uchi Electronic (M) Sdn Bhd和位于中国东莞的Uchi Technologies (Dongguan) Co., LTD则是负责电子组装。

UCHITEC所设计和制造的产品实际用于居家用品及生物科技用品上。居家用品中的产品,主要是全自动化咖啡机,贡献了公司大部分营业收入,即2022财年营业额的约88.0%。

另外,公司的生物科技相关的产品,如高精度称重秤(“High Precision Weighing Scales)、离心机(”Centrifuges“)和冷冻机(”Deep Freezers“),在2022财年贡献了约11.0%的营业额。

从2022年年报来看,公司97.0%以上的产品都出口到欧洲市场,包括瑞士(45.0%)、葡萄牙(43.0%)、德国(7.0%)以及英国(2.0%)。其余市场为美国(1.0%)、中国(1.0%)和其他国家(1.0%)。

据了解,UCHITEC最大的客户是来自于瑞士的咖啡机制造商JURA,而该客户贡献了公司2022财年全年营业额的约92.3%。

接下来,就来看看UCHITEC最新季度报告(Q1FY2023)的表现吧。

营业额比较(YoY +19.79%、QoQ +5.24%)

截至2023年3月31日,公司的营业收入约为RM57.43 million ,与去年同期的 RM47.94 million左右相比,增加了约RM9.49 million 或 19.79%。这主要是由于客户对公司产品和服务的需求增加所致。

其中,约RM51.77 million的营业额是来自居家用品,同比增长约22.86%。不过,生物科技用品的收入则同比减少了2.58%左右,至RM5.65 million。

在地域方面,欧洲、亚洲和美国的市场收入分别同比上涨了约18.42%、122.78%和35.94%,分别达到RM55.57 million、RM1.23 million和RM0.62 million。

较上一季度,公司的营业额则是增加约RM2.86 million或5.24%。

税后盈利比较(YoY +41.20%、QoQ +15.63%)

在对产品和服务的强劲需求推动下,公司的净利润约为RM37.80 million,同比和环比分别增长了约41.20%和15.63%。

其实,公司在本季度有一笔出售持有待售资产的收益,共约RM11.30 million。因此,经过调整后,公司的核心净利润便是RM26.50 million左右。

值得一提的是,该公司旗下的Uchi Optoelectronic (M) Sdn Bhd在今年的1月9日从国际贸易和工业部(“Ministry of International Trade and Industry”或“MITI”)获得了长达5年的税务减免,这无疑有利于公司未来的盈利收益。

前景展望

管理层预计分销地理区域和产品收入贡献率不会发生任何重大变化。可能影响 UCHITEC 业绩的因素包括美元汇率波动,材料短缺,材料价格波动和劳动力供应短缺。然而,管理层有信心维持公司的盈利能力和健康的资产负债表。

总而言之,UCHITEC是为不多的能够保持着高营业利润率且无负债的净现金公司之一。此外,公司的的派息率也非常高,平均在90.0% 以上。

那么,对于当前市盈率(P/E)为约11.13倍的UCHITEC,各位读者有什么看法呢?

|

|  28 May 2023, 7:45:31 PM 28 May 2023, 7:45:31 PM

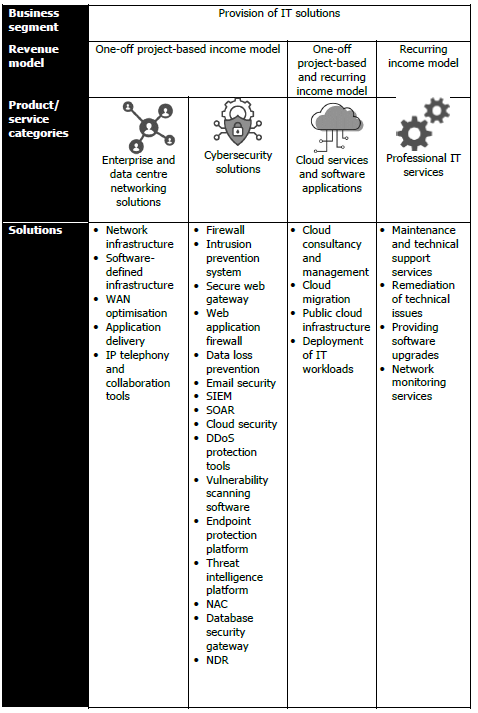

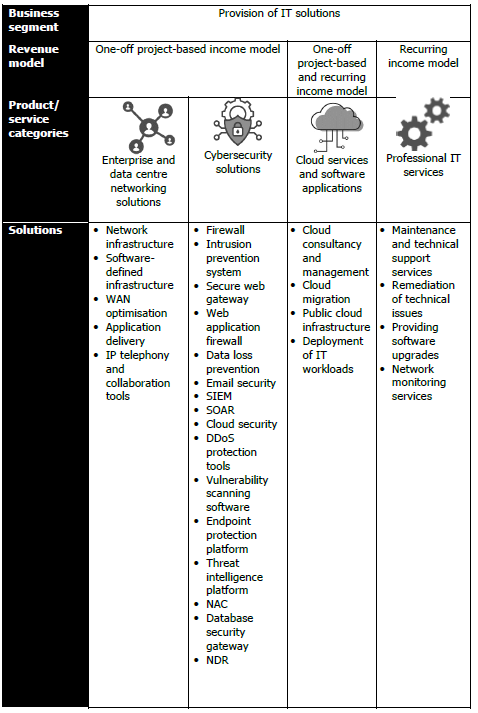

Cloudpoint Technology Berhad (CLOUDPT, 0277) which was founded in 2003, is a company that offers Information Technology (IT) solutions and specializes in providing professional IT services such as data center and network security cloud services. The company's clientele includes industries such as finance, insurance, telecommunications and etc, with the finance sector representing the largest share, accounting for approximately 88.65% of the total revenue in the fiscal year 2022. While the company serves clients from various industries, its market presence is solely in Malaysia.

According to the prospectus, the company's primary source of revenue comes from providing enterprise and data center networking solutions, contributing approximately RM 36.52 million or 40.31% of the revenue in the fiscal year 2022. This involves designing network infrastructure for clients and overseeing the installation and configuration of necessary hardware and software to establish complete enterprise and data center architectures. Notably, the company procures hardware and software from reputable suppliers and distributors such as Cisco Systems, Inc., F5, Inc., and VSTECS (5162).

Another significant aspect of the company's business is cybersecurity solutions, which involve implementing necessary network security measures for clients, including firewalls, data loss prevention, email security systems, and DDoS protection tools. This business segment accounts for approximately 40.09% of the revenue in the fiscal year 2022.

The remaining revenue is generated from providing professional IT services, including maintenance, technical support, software upgrades, and network monitoring.

For your information, the professional IT service business can bring continuous income or recurring income to the company, while the enterprise and data center network solution business and the cybersecurity solution business are one-time project income.

It is worth mentioning that in April 2022, CLOUDPT also launched cloud services and software applications. This entails transferring and storing clients' enterprise data in the cloud using platforms such as Alibaba Cloud, AWS, Huawei Cloud, Microsoft Azure, among others. This business segment creates two revenue models: one-time project income from initial consulting and setup services and recurring income from client subscriptions.

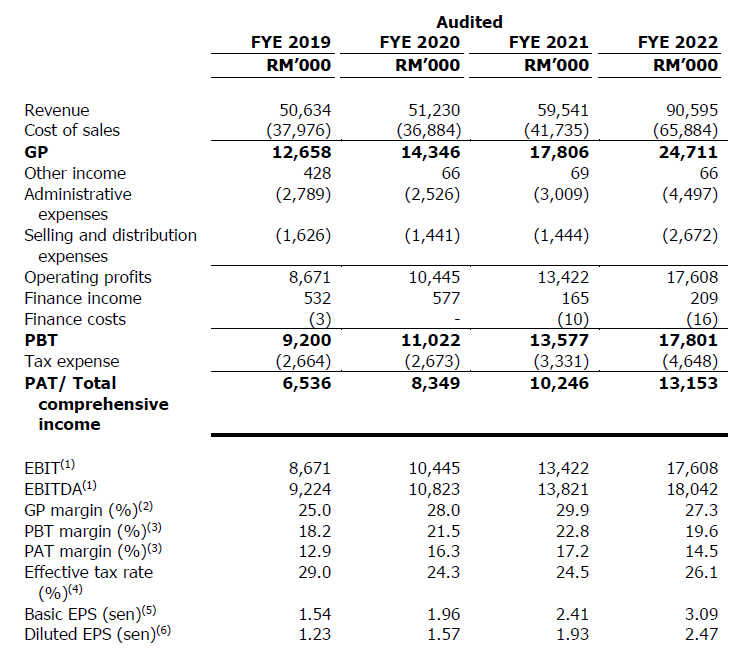

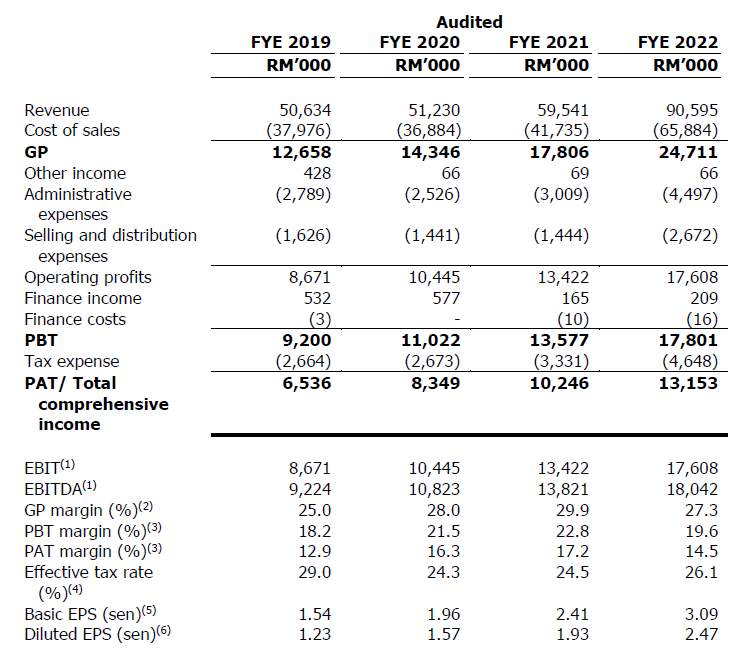

Financially, the company has demonstrated impressive performance in recent years. According to the disclosed data, Cloudpoint Technology Berhad achieved approximately RM 50.63 million, RM 51.23 million, RM 59.54 million, and RM 90.59 million in revenue for the fiscal years 2019, 2020, 2021, and 2022, respectively, showing a compound annual growth rate of around 21.60%.

Furthermore, the company's net profit has increased year by year, reaching RM 6.53 million, RM 8.34 million, RM 10.24 million, and RM 13.15 million in 2019, 2020, 2021, and 2022, respectively. This indicates Cloudpoint Technology Berhad's steady growth and remarkable profitability.

However, like any other business, CLOUDPT also faces certain commercial risks. Firstly, due to intense competition and the evolving nature of the cloud services and network security market, CLOUDPT needs to continually innovate and upgrade its technology to maintain competitiveness. Additionally, reliance on finance institutions as primary clients poses risks since any reduction in network security expenditure or a shift to other vendors by these institutions could impact CLOUDPT's business.

For reference, CLOUDPT has an IPO issue price of RM 0.38, with a price-to-earnings ratio (PE) of approximately 15.40. Compared to comparable peers in the industry, such as INFOTEC (0253) with a current PE ratio of approximately 23.68, CLOUDPT's valuation is considered favorable.

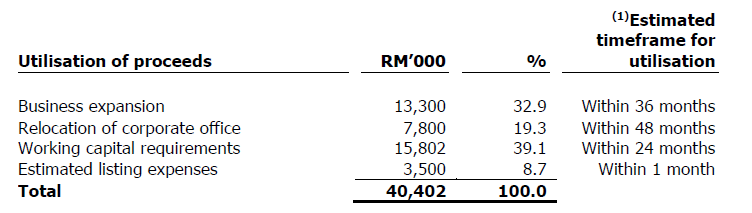

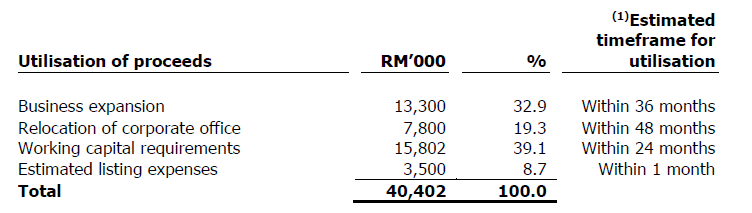

Looking ahead, Cloudpoint Technology Berhad will continue expanding its business and providing additional value to clients. To this end, the company plans to utilize RM 13.30 million or 32.90% of the funds raised from the IPO to establish a new Security Operations Centre (SOC) and strengthen its existing Network Operations Centre (NOC) to monitor and manage potential network attacks. Additionally, the company intends to develop its own public cloud infrastructure to offer cloud-based services to clients.

Furthermore, RM 7.80 million or 19.30% of the funds raised will be allocated towards relocation and establishing new office premises since the current office space is leased.

Moreover, RM 15.80 million or 39.1% of the funds raised will be used as working capital for the company, with the remaining RM 3.50 million or 8.70% allocated for IPO expenses.

(Note: CLOUDPT has publicly issued approximately 159.48 million ordinary shares, aiming to raise approximately RM 40.40 million)

It is worth noting that the initial public offering (IPO) of CLOUDPT was oversubscribed by approximately 112.94 times. With this in mind, will Cloudpoint Technology Berhad, set to be listed on the stock exchange on May 29th, ignite a new wave of investment enthusiasm?

|

|  28 May 2023, 11:19:07 AM 28 May 2023, 11:19:07 AM

创立于2003年的Cloudpoint Technology Berhad(CLOUDPT、0277)是一家提供信息技术(“Information Technology”或“IT”)解决方案的公司,专注于为企业提供数据中心、网络安全云服务等专业IT服务。公司的客户来自金融机构、保险、电信等行业,其中金融机构的占比最大,占2022财年总营业额的88.65%左右。虽然公司的客户来自各行各业,但100.00%的市场都在马来西亚。

根据招股说明书,公司的主要业务收入来自于提供企业与数据中心的网络解决方案(“Enterprise and Data Centre Networking Solutions”),在2022财年贡献了约RM 36.52 million或40.31%的营业额。其业务是为客户设计网络基础设施,同时负责安装和配置所需的硬件和软件,以构建完整的企业与数据中心架构。值得一提的是,这些硬件和软件均采购自知名的供应商和经销商,例如思科系统公司(Cisco Systems, Inc)、F5公司(F5, Inc)、VSTECS(5162)等。

接着是网络安全解决方案(“Cybersecurity Solutions“)业务,也就是为客户安置所需的网络防护设施,如防火墙、 数据丢失防护、电子邮件安全系统、DDoS保护工具等。该业务约占2022财年营业额的40.09%。

其余的业务收入则来自提供专业的IT服务(“Professional IT Services“),即提供维护和技术支援、软件升级和网络监控等服务。

据了解,专业IT 服务业务可为公司带来持续性收入(”Recurring Income“),而企业与数据中心网络解决方案业务和网络安全解决方案业务则是属于一次性的项目收入。

值得注意的是,CLOUDPT 在 2022 年4 月还推出了云服务和软件应用程序(“Cloud Services and Software Applications“)。简单来说就是将客户的企业数据传输和储存到云端,例如Alibaba Cloud、AWS、Huawei Cloud、Microsoft Azure等云平台。此业务能为公司创造两种营收模式;前期为客户提供的咨询和设置的服务是属于一次性的项目收入,而后期客户的订阅服务则能带来持续性收入。

财报方面,公司过去几年的业绩都十分亮眼。根据CLOUDPT所公布的数据,公司在2019财年,2020财年,2021财年及2022财年分别获得了约RM50.63 million,RM51.23 million,RM59.54 million和RM90.59 million的营业收入,呈现21.60%左右的复合年增长率。

此外,公司的净利润也在逐年上升,2019年净利润达RM6.53 million,2020年净利润达RM8.34 million,2021年净利润达RM10.24 million,2022年净利润达RM13.15 million。这意味着CLOUDPT的业务一直在稳健发展,并拥有出色的盈利能力。

然而,正如任何其他企业一样,CLOUDPT也面临着一些商业风险。首先,由于行业竞争激烈,云服务和网络安全市场在不断变化和发展,CLOUDPT需要不断创新和升级技术,以保持竞争力。另外,依赖金融机构作为主要客户也存在一定的风险,因为任何金融机构缩减网络安全开支或转向其他供应商都可能对CLOUDPT的业务产生影响。

作为参考,CLOUDPT是以RM0.38作为IPO发行价,而市盈率(“PE”)约为15.40倍。与公司较为接近的同行对比,比如INFOTEC(0253)当前约23.68倍的PE,CLOUDPT的估值是便宜的。

展望未来,CLOUDPT将继续扩展业务,为客户提供更多的附加价值。因此,公司将动用上市所筹资的RM13.30 million或32.90%设立新的 Security Operations Centre(“SOC”)。并加强现有的 Network Operations Centre(“NOC”)以监控和管理潜在的网络攻击。同时,公司还计划开发新的而且是自家的公共云基础设施(“Public Cloud Infrastructure”),以便为客户提供云端的服务。

除此之外,CLOUDPT也会把所筹资的RM7.80 million或19.30%用在搬迁及设立新办公室,因为目前的办公楼是租的。

另外,RM15.80 million或39.1%的募集资金将用作公司营运资金,其余RM3.50 million或8.70%将用于上市费用。

(注:CLOUDPT将公开发售约1亿5948万普通股,预计能筹集RM40.40 million 左右)

不得不分享,CLOUDPT的首次公开发行(IPO)就被超额认购112.94倍左右。那么,即将于5月29日在创业板上市的Cloudpoint Technology Berhad,会否再掀起一波投资热潮呢?

|

|  24 May 2023, 8:00:24 PM 24 May 2023, 8:00:24 PM

The pharmaceutical industry plays a crucial role as an integral part of the global healthcare system. With the increasing global population and longer life expectancy, the demand for medications is also on the rise. Particularly in developing countries, improvements in healthcare standards and an aging population are driving the demand and reliance on pharmaceuticals. According to a survey conducted by the Pharmaceutical Association of Malaysia (PhAMA), the pharmaceutical industry contributed RM6.00 billion to Malaysia's Gross Domestic Product (GDP), and it is expected to contribute another RM10.00 billion by 2024.

A few days ago, Duopharma Biotech Berhad (DPHARMA, 7148), a renowned Malaysian pharmaceutical company, announced impressive performance results with record-high revenue and profit for the first quarter.

As a reference, DPHARMA is a pharmaceutical company equipped with advanced medical technology. It was established in 1978 and went public in 2002. The company operates three research and manufacturing facilities in the Klang Valley of Malaysia, located in Bangi, Klang, and Glenmarie, Shah Alam. Additionally, DPHARMA has subsidiaries in Singapore, the Philippines, and Indonesia. Not to mention that the company also collaborates with the Indian pharmaceutical company Biocon Limited.

DPHARMA's main business involves the research, development, and manufacturing of generic drugs and healthcare products, which are then sold to private and government healthcare centres. Based on the 2022 annual report, approximately 57.29% of the revenue comes from private healthcare centres, while the remaining 42.71% comes from government or public healthcare centres. The company has a broad market presence and has exported its products to 31 countries. However, Malaysia remains DPHARMA's primary sales market, accounting for approximately 93.99% of the revenue in the fiscal year 2022.

Now, let's delve into the latest performance announced by DPHARMA for Q1FY2023.

Revenue Comparison (YoY +7.81%, QoQ +31.92%)

As of March 31, 2023, the company achieved approximately RM200.47 million in revenue, representing an increase of approximately RM14.54 million or 7.81% compared to the same period last year, when revenue was RM185.94 million. This growth is primarily attributed to an increase in sales volume of prescription drugs.

Out of the RM200.47 million revenue, approximately RM188.73 million came from Malaysian customers, while the remaining RM11.74 million came from overseas sales.

Compared to the previous quarter, the company's revenue significantly rose by approximately RM48.52 million or 31.92%, primarily driven by increased demand for medications from the Ministry of Health. It is worth noting that the previous quarter (4QFY22) usually experiences lower purchases from the Ministry of Health due to the year-end accounting period. Therefore, the orders from the Ministry of Health witnessed a significant increase this quarter.

Net Profit Comparison (YoY +11.53%, QoQ +31.87%)

Driven by the overall robust revenue performance, DPHARMA achieved a net profit of approximately RM22.63 million this quarter, representing a year-on-year and quarter-on-quarter growth of approximately 11.53% and 31.87%, respectively.

However, the increase in electricity costs and labor expenses has affected the company's profitability to some extent. It is anticipated that the company may offset the rising operating costs by increasing product selling prices in the future.

Outlook

The company is poised to benefit from patients returning to hospitals, increased government allocations to the Ministry of Health, and a gradual stabilization of active pharmaceutical ingredient prices. Additionally, DPHARMA's introduction of pure plant-based healthcare products such as Champs and Flavettes will be advantageous for the company's future profit growth.

It is worth mentioning that the company currently holds a three-year contract valued at RM375.00 million, which involves supplying reconstituted insulin formulations (Insugen-Insulin Recombinant Human Formulations) to the Ministry of Health until April 2025. Furthermore, the contracts with government hospitals and clinics for the supply of both pharmaceutical and non-pharmaceutical products have been extended until June 30, 2023.

In addition, Malaysia plans to open five public hospitals and 19 private hospitals in the next three years, further enhancing the company's growth potential.

Given the high growth potential and the current price-to-earnings ratio (P/E) of 19.52 times, what are your thoughts on DPHARMA?

|

|  24 May 2023, 12:09:40 AM 24 May 2023, 12:09:40 AM

制药行业作为全球医疗保健体系的重要组成部分,一直以来都扮演着至关重要的角色。随着全球人口的增长和寿命的延长,对药物的需求也在增加。特别是在发展中国家,医疗水平的提高和人口老龄化将推动对药物的需求和依赖。根据马来西亚医药协会(“Pharmaceutical Association of Malaysia”或“PhAMA”)的调查,制药行业为马来西亚国内生产总值(“GDP“)贡献了RM6.00 billion,预计到2024年,该行业能做出高达RM10.00 billion的贡献。

昨日,一家马来西亚知名的制药公司Duopharma Biotech Berhad(DPHARMA、7148)公布了非常亮眼的业绩,即首季营业额及盈利均创历史新高。

作为参考,DPHARMA是一家拥有先进医疗技术的制药公司,创立于1978年,并于2002年上市。该公司在马来西亚的巴生谷拥有三个研发和制造工厂,分别位于Bangi、Klang和Shah Alam的Glenmarie。此外,DPHARMA在新加坡、菲律宾和印尼均设有子公司,印度药剂公司Biocon Limited也是该公司的合作伙伴之一。

DPHARMA的主要业务是研发和制造仿制药物和保健品,然后将其销售给私人和政府医疗机构。从2022年年报来看,约57.29%的收入来自私人医疗机构,剩余42.71%的收入则来自政府医疗机构。公司拥有广泛的市场,迄今已将产品出口到31个国家。不过,马来西亚仍是DPHARMA的主要销售市场,约占据了2022财年营业额的93.99%。

接下来,就来探讨DPHARMA最新公布的业绩(Q1FY2023)吧。

营业额比较(YoY +7.81%、QoQ +31.92%)

截至2023年3月31日,公司获得了约RM200.47 million 的营业收入,较去年同期的 RM185.94 million,增加了约RM14.54 million 或 7.81%。这主要是由于处方药物销售量增加所致。

在RM200.47 million的营业额中,约RM188.73 million是来自马来西亚客户,剩余RM11.74 million左右则来自海外的销售。

对比上个季度,公司的营收大幅上涨了约RM48.52 million或31.92%,主要归功于卫生部对药物的需求增加。据了解,由于第四季度通常是卫生部的结账期,所以上一季度(4QFY22)的年底采购量较少。因此,本季度来自卫生部的订单就大幅增加。

税后盈利比较(YoY +11.53%、QoQ +31.87%)

在整体强劲营业收入的推动下,DPHARMA在本季实现了约RM22.63 million的净利润,同比和环比分别增长了约11.53%和31.87%。

但是,电费和劳动力成本的上扬导致了公司的盈利能力受到一定程度的打击。个人认为,未来公司可能会通过提高产品销售价格来弥补上升的营业成本。

前景展望

公司将受益于病患继续返回医院,政府对卫生部的更高拨款以及活性药物成分价格的逐渐稳定。另外,DPHARMA推出纯植物保健品,如Champs、Flavettes等,将非常有利于公司未来的盈利增长。

值得一提的是,该公司目前拥有价值为RM375.00 million为期三年的合约,向卫生部(“Ministry of Health”)提供重组胰岛素制剂 (“Insugen-Insulin Recombinant Human Formulations”),而合同有效期至2025年4月。同时,公司与政府医院和诊所供应药品和非药品产品的合约已经进一步延长至2023年6月30日。

除此之外,马来西亚计划在未来3年内开设5所公立医院和19所私立医院,这将进一步提升公司的增长潜力。

那么,各位读者对于增长潜能高、当前市盈率(P/E)为约19.52倍的DPHARMA有什么看法呢?

|

|  18 May 2023, 9:31:30 PM 18 May 2023, 9:31:30 PM

A few days ago, the National Property Information Centre (NAPIC) released remarkable data on the value and volume of real estate transactions. According to the announcement, Malaysia achieved its highest real estate transaction value since 2001, reaching RM179.07 billion in 2022. Additionally, real estate transaction volume experienced a double-digit growth in 2022, increasing by approximately 29.45% from 300,497 transactions in 2021 to 389,000 transactions.

However, given the challenging macroeconomic environment, NAPIC expresses concerns about the real estate market in 2023. Nevertheless, S P Setia Berhad (SPSETIA, 8664), one of Malaysia's largest property developers, has achieved commendable performance in the first quarter of this year.

Without further ado, let's delve into the latest quarterly performance (Q1FY2023) announced by SPSETIA yesterday.

Revenue Comparison (YoY +11.59%, QoQ -76.71%)

As of March 31, 2023, the company achieved approximately RM967.67 million in revenue, representing a year-on-year increase of about 11.59%. In terms of sales, SPSETIA recorded around RM1,030.00 million. The Malaysian projects accounted for 87.67% of the sales, totaling approximately RM903.00 million. Simultaneously, overseas projects contributed around RM130.00 million, representing approximately 12.62% of the sales.

The company's outstanding revenue primarily stems from land sales in Australia, the central region of Malaysia, and Selangor. These include Setia Alam, Setia Eco Park, Precinct Arundina, Setia Alam Impian, and Temasya Glenmarie in Shah Alam; Setia EcoHill, Setia EcoHill 2, and Setia Mayuri in Semenyih; Setia Eco Glades and Setia Safiro in Cyberjaya; Setia Eco Templer in Rawang; Setia Warisan Tropika in Sepang; Setia Alamsari (north and south) in Bangi; Bandar Kinrara in Puchong; Setia Bayuemas and Trio by Setia in Klang; Setia Sky Seputeh in Seputeh; KL Eco City in Jalan Bangsar; Bukit Indah, Setia Indah, Setia Tropika, Setia Eco Cascadia, Setia Business Park I and II, Setia Eco Gardens, Setia Sky 88, Taman Rinting, Taman Pelangi, Taman Pelangi Indah, and Taman Industri Jaya in Johor; Setia Sky Vista, Setia V Residences, Setia Sky Ville, Setia Greens, and Setia Fontaines in Penang; as well as UNO Melbourne and Sapphire by the Gardens in Australia.

Due to the handover of the UNO Melbourne (Phase 1) and Sapphire by the Gardens projects in the previous quarter (Q4FY2022), the company's revenue declined by approximately 76.71% compared to the preceding quarter.

Net Profit Comparison (YoY -17.85%, QoQ -38.60%)

Due to increased marketing costs and administrative expenses, the company's net profit declined by approximately 17.85% year-on-year and 38.60% quarter-on-quarter to around RM55.45 million.

Additionally, the rise in interest rates resulted in increased financial costs, which pressured the company's profitability in this quarter.

It is worth noting that as of March 31, the company has received total orders worth approximately RM512.00 million. Furthermore, SPSETIA successfully sold property inventory worth around RM107.00 million during this quarter.

Outlook

The management states that as of March 31, 2023, the company has the total unbilled sales amounted to RM7.17 billion, with 45 ongoing projects and a remaining landbank of 7,459 acres, indicating a total development value of RM128.02 billion. Hence, SPSETIA is poised for growth and resilience amidst the challenging market conditions.

|

|  18 May 2023, 12:04:06 AM 18 May 2023, 12:04:06 AM

数天前,国家房地产信息中心(“National Property Information Centre”或“NAPIC”)公布了令人瞩目的房地产交易价值及交易量数据。根据文告,马来西亚2022年的房地产总交易价值创下2001年以来的最高价值,即RM179.07 billion。此外,马来西亚房地产的交易量也在2022年呈现两位数的增长;从2021年的300,497.00笔交易,增加约29.45%至389,000.00笔交易。

然而,鉴于充满挑战的宏观经济环境,NAPIC对2023年的房地产市场感到担忧。话虽如此,马来西亚最大的房地产开发商之一S P Setia Berhad(SPSETIA、8664)在今年首季取得了不俗的成绩。

事不宜迟,就来探讨SPSETIA在今日所公布的最新季度(Q1FY2023)的表现吧。

营业额比较(YoY +11.59%、QoQ -76.71%)

截至2023年3月31,公司取得了约RM967.67 million的营业额,同比增加了约11.59%。在销售额方面,SPSETIA录得了RM1,030.00 million左右。其中,马来西亚项目占销售额的87.67%,总计约RM903.00 million。与此同时,海外项目贡献了约RM130.00 million,占销售额约12.62%。

该公司的出色营业额主要来自澳大利亚、马来西亚中部地区以及及雪兰莪土地销售,其包括位于Shah Alam的Setia Alam、Setia Eco Park、Precinct Arundina、Setia AlamImpian和Temasya Glenmarie,位于Semenyih的Setia EcoHill、Setia EcoHill 2和Setia Mayuri,位于Cyberjaya的Setia Eco Glades和Setia Safiro,位于Rawang的Setia Eco Templer,位于Sepang的Setia Warisan Tropika,位于Bangi的Setia Alamsari(北部和南部),位于Puchong的Bandar Kinrara,位于Klang的Setia Bayuemas和Trio by Setia,位于Seputeh的Setia Sky Seputeh,位于Jalan Bangsar的KL Eco City,位于柔佛的Bukit Indah、Setia Indah、Setia Tropika、Setia Eco Cascadia、Setia Business Park I和II、Setia Eco Gardens、Setia Sky 88、Taman Rinting、Taman Pelangi、Taman Pelangi Indah和Taman Industri Jaya,位于槟城的Setia Sky Vista、Setia V Residences、Setia Sky Ville、Setia Greens和Setia Fontaines,以及位于澳大利亚的UNO Melbourne和Sapphire by the Gardens。

由于UNO Melbourne项目(第一阶段)和Sapphire by the Gardens项目已于上一季度(2022年第四季度)完成移交,导致公司在本季的营业额环比减少了约76.71%。

税后盈利比较(YoY -17.85%、QoQ -38.60%)

鉴于营销成本及行政费用的增加,公司的净利润同比及环比分别下滑了约17.85%和38.60%,至RM55.45 million左右。

除此之外,利息上涨导致了财务成本增加,令公司本季盈利受到打压。

值得注意的是,截至3月31日,公司已接获总计约RM512.00 million的订单。此外,SPSETIA在本季度也成功售出价值约RM107.00 million的产业库存。

前景展望

管理层表示,截至 2023 年 3 月 31 日,未开票总销售额为 71.7 亿令吉、45 个正在进行的项目和有效剩余土地储备 7,459 英亩,总开发价值为 1,280.2 亿令吉,SPSETIA 有望在充满挑战的市场条件下实现增长并在挑战中保持坚韧。

|

|  12 May 2023, 10:23:14 PM 12 May 2023, 10:23:14 PM

Alcohol consumption has become a common social and cultural activity in today's society. With the continuous development of the world economy and the improvement of people's living standards, the demand for alcoholic beverages has continued to grow, and the alcohol industry has attracted more attention nowadays.

Carlsberg Brewery Malaysia Berhad (CARLSBG, 2836), one of Malaysia's largest beer brands, recently released an excellent quarterly performance report, with record-high revenue for the first quarter.

CARLSBG is a liquor producer established in 1969 and is one of the holding subsidiaries of the Carlsberg Group in Malaysia. The company mainly produces and sells beer, cider, and other beverages, with its main brands including Carlsberg, Asahi, Somersby, Connor's, Royal Stout, etc.

CARLSBG has production facilities and online and offline sales networks in Malaysia, Singapore, Sri Lanka, and other regions, and is committed to becoming one of the largest beer and beverage manufacturers in Asia. According to the 2022 annual report, Malaysia is CARLSBG's largest customer market, accounting for approximately 70.10% of the total revenue for the 2022 fiscal year. Singapore is the second-largest, accounting for approximately 28.68% of the total revenue.

Let's take a look at CARLSBG's latest financial results (Q1FY2023).

Revenue Comparison (YoY +0.97%, QoQ +7.74%)

For the first quarter ended March 31, 2023, the company achieved approximately RM660.20 million in revenue, an increase of approximately RM6.35 million or 0.97% compared to the same period last year (RM653.85 million). This was due to increased consumption during the Chinese New Year earlier this year.

Of the RM660.20 million in revenue, approximately RM469.30 million came from Malaysian customers, an increase of approximately 3.35% compared to the same period last year. However, Singapore's revenue decreased by approximately 4.41% YoY to around RM190.90 million. Management stated that due to the earlier Chinese New Year this year, the sales period was shortened during the festive interval; otherwise, the company's sales volume could have been further increased.

Driven by the Chinese New Year, CARLSBG's revenue increased by approximately RM47.45 million or 7.74% QoQ.

Net Profit Comparison (YoY -7.15%, QoQ +41.45%)

Compared to the same period last year, the company's net profit decreased by approximately RM6.55 million or 7.15% to around RM85.04 million. This was mainly due to an increase in marketing expenses. In addition, the profit sharing from the joint venture company Lion Brewery (Ceylon) PLC in Sri Lanka also decreased, leading to a YoY decline in CARLSBG's net profit.

According to the quarterly report, due to the significant depreciation of the Sri Lankan rupee against the Malaysian ringgit, the joint venture company's profit share in Sri Lanka decreased by 52.40% to around RM3.20 million.

Despite this, compared to the previous quarter, the company's net profit increased significantly by approximately RM24.92 million or 41.45%. This was because there were no one-off expenses in this quarter, i.e. the disposal loss of the old bottling line and lower marketing investment.

It is worth mentioning that the company also announced a first interim dividend of RM 0.2100 for this quarter, with an ex-date of May 24, 2023, and payment on June 8, 2023.

Outlook

The global economy continues to face uncertainty, with expected increases in inflationary pressures. Challenges will arise from disruptions to global supply chains and rising prices. To address these challenges, the company will continue to implement its SAIL'27 corporate strategy, focusing on strengthening its core beer business, increasing the proportion of high-end products, and continuing to develop non-alcoholic beer to attract more consumers who prefer non-alcoholic beverages.

Furthermore, the lifting of global travel restrictions is expected to boost consumer demand, particularly with an anticipated increase in tourist numbers in Malaysia and Singapore. Not to mention, the end of the Prosperity Tax in 2022 will also have a positive impact on the company's profitability.

In light of these developments, how should readers view CARLSBG, with a current P/E ratio of 21.43 and dividend yield of 4.04%?

|

|  11 May 2023, 11:01:20 PM 11 May 2023, 11:01:20 PM

在当今社会,饮用酒精饮料已经成为了一种普遍的社交和文化活动。随着世界经济的不断发展和人们生活水平的提高,酒类市场的需求不断增长,酒精饮料行业也越来越受到人们的关注。

作为马来西亚最大的啤酒品牌之一的Carlsberg Brewery Malaysia Berhad(CARLSBG、2836)在数日前发布了出色的季度业绩表现,那就是首季的营业额创历史新高。

作为参考,CARLSBG是一家酒类生产商,成立于1969年,是Carlsberg Group在马来西亚的控股子公司之一。公司主要生产和销售啤酒、苹果酒和其他饮料,旗下主要品牌包括Carlsberg、Asahi、Somersby、Connor's和Royal Stout等。

CARLSBG在马来西亚、新加坡和斯里兰卡等地区拥有生产设施及线上和线下的销售网络,致力于成为亚洲最大的啤酒和饮料制造商之一.。从2022年年报来看,马来西亚是CARLSBG最大的客户市场,占2022财年总收入70.10%左右。其次是新加坡,占据了约28.68%的总营业额。

接下来,让我们来看看CARLSBG最新公布的业绩(Q1FY2023)。

营业额比较(YoY +0.97%、QoQ +7.74%)

截至2023年3月31日的第一季度,公司取得了约RM660.20 million 营业收入,比去年同期的 RM653.85 million,增加了约RM6.35 million 或 0.97%。这是因为今年年初的农历新年,带动了消费。

在RM660.20 million的营业额中,约RM469.30 million是来自马来西亚客户,较去年同期增加了约3.35%。不过,新加坡的营收却按年减少约4.41%至RM190.90 million左右。管理层表示,由于今年的农历新年较早,节日期间的销售期有所缩短,否则公司的销量有望进一步提升。

在农历佳节的带动下,CARLSBG的营收环比增加了约RM47.45 million 或7.74%。

税后盈利比较(YoY -7.15%、QoQ +41.45%)

与去年同期相比,公司的净利润减少了约RM6.55 million或7.15%至RM85.04 million左右。这主要是由于营销支出增加所致。此外,斯里兰卡联营公司Lion Brewery(Ceylon)PLC利润分成下降,也导致CARLSBG的净利润出现同比下滑迹象。

根据季度报告里显示,由于斯里兰卡卢比(“Sri Lankan Rupee”)对马币(“RM”)的汇率大幅贬值,其联营公司的利润份额下降了52.40%至RM3.20 million 左右。

尽管如此,对比上一季度,公司的净利润大幅增加了约RM24.92 million或41.45%。这是因为本季度没有上一季度的一次性费用,例如旧装瓶线的处置损失和较低的营销投资。

值得一提的是,公司也在本季度中宣布派发 RM 0.2100 的第一次中期股息,除权日于 5 月 24 日,将于 2023 年 6 月 8 日支付。

前景展望

全球经济仍然面临不确定性,通货膨胀压力预计将会上升。全球供应链中断和物价的上涨将构成挑战。因此,公司将继续推进 SAIL'27 企业战略,强化核心啤酒业务、提高高端产品比重,并继续开发无酒精啤酒,以吸引更多偏好无酒精饮料的消费者。

此外,全球旅行限制的解除有望提振消费者需求,尤其是在马来西亚和新加坡预计游客人数增加的情况下。2022年的繁荣税结束也将对公司的盈利润产生积极影响。

那么,对于当前市盈率为21.43倍、股息率为4.04%的CARLSBG,读者怎么看呢?

|

|  10 May 2023, 6:20:30 PM 10 May 2023, 6:20:30 PM

Yesterday, Hartalega Holdings Berhad (HARTA, 5168), one of Malaysia's largest rubber glove manufacturers, reported a decline in revenue and an increase in losses for the quarter, which is not surprising given the declining demand for gloves and the significant drop in average selling price (ASP). This comes after KOSSAN (7153) also reported a decline in performance last month.

Before that, let’s get to know about the company briefly. HARTA was founded in 1988 and is headquartered in Selangor. It went public on the Main Board of Bursa Malaysia in 2008. As of its 2022 financial report, the company has seven factories and an annual glove production capacity of 44.0 billion units. It has become one of the world's largest nitrile glove manufacturers, with most of its gloves sold overseas and exported to over 70 countries. North America accounts for the majority of the company's revenue in 2022, representing approximately 54.0%. The remaining market share comes from Europe (23.5%), Asia (13.5%), Australia (5.2%), South America (1.9%), the Middle East (0.8%), Malaysia (0.4%), and other countries (0.7%).

The day before the latest quarterly report was released, HARTA announced the closure of its Bestari Jaya (BB) factory and the integration of its operations into the Next Generation Integrated Glove Manufacturing Complex (NGC) in Klang. The factory closure is expected to last for six months until the end of 2023.

According to the statement, BB has 4 production plants and 40 production lines, with an annual production capacity of 13.0 billion gloves, accounting for about 30.0% of the total production capacity. Unfortunately, due to outdated technology, BB's operating efficiency is lower than that of NGC. For the information, each production line of NGC has an annual production capacity of up to 388.0 million gloves, while BB's production line capacity is 325.0 million gloves. This has led to higher energy, labor, and maintenance costs for BB.

Now, let's discuss HARTA's performance for the latest quarter (Q4FY2023).

Revenue Comparison (YoY -46.8%, QoQ +11.7%)

As of March 31, 2023, the company's revenue decreased by about RM452.9 million or 46.8% YoY to about RM515.7 million due to the decline in glove ASP and sales volume. In addition, the company continues to face unfavorable factors such as market oversupply and customer inventory adjustments.

However, compared to the previous quarter, the company's revenue increased by about RM53.9 million or 11.7% this quarter due to an increase in glove sales volume.

Net Profit Comparison (YoY -52.9%, QoQ -848.7%)

Due to the simultaneous decline in glove sales volume and ASP, the company's net loss further deteriorated, increasing from about RM197.9 million in the same period last year to about RM302.7 million. This was because the company had a one-time asset impairment loss of RM347.0 million this quarter due to the shutdown of the BB factory mentioned above.

In addition to the decrease in production utilization rate, the increase in energy and labour costs has also resulted in an 848.7% quarter-on-quarter increase in the company's net loss.

Outlook

The global medical glove market is still facing serious challenges. During the pandemic, the industry's production capacity continued to expand, leading to a significant accumulation of inventory and a market supply-demand imbalance. In addition, the glove industry is facing pressure from rising costs, such as energy and labour. Therefore, the company expects another one-time expense in the upcoming 2024 fiscal year, namely the cost of retrenchment and contract obligations, amounting to approximately RM70.0 million.

Given this challenging situation, HARTA has launched a five-year strategic plan, which includes the aforementioned actions of closing its BB factory and streamlining operations by consolidating them at NGC. Management has stated that this move will lower operating costs, thereby enhancing the company's overall competitiveness.

In summary, although HARTA's net loss for the current quarter continues to widen, the company still holds a huge cash reserve of approximately RM1,724.4 million. This will enable the company to continue developing towards innovation and automation, becoming a technology-driven glove company at the forefront of the industry.

|

|  09 May 2023, 11:30:27 PM 09 May 2023, 11:30:27 PM

继KOSSAN(7153)上月底公布业绩下滑的季报后,无独有偶,马来西亚最大的橡胶手套制造商之一的Hartalega Holdings Berhad(HARTA、5168)也于今日公布了营收减少、亏损扩大的季度表现。这与手套需求量的递减及平均售价(“ASP”)大幅下滑密不可分。

先简单介绍HARTA这家公司。总部位于雪兰莪的HARTA创立于1988年,并于2008年在马交易所的主板上市。从2022年的财报来看,该公司目前拥有7家工厂,手套年产能达44.0 billion 只,如今已成为世界上规模最大的丁腈手套(“Nitrile Glove”) 生产商之一。此外,公司手套大部分销售到国外,现已出口到70多个国家。其中,北美洲 占2022财年营业额的大部分,约占54.0%。接下来的市场分额来自欧洲 (23.5%)、亚洲(13.5%)、澳洲(5.2%)、南美洲(1.9%)、中东(0.8%)、马来西亚(0.4%)以及其他国家(0.7%)。

在HARTA发布最新季度报告的前一天,该公司宣布将关闭其Bestari Jaya (“BB”)工厂,并将其业务整合到位于雪邦的下一代综合手套制造厂(“Next Generation Integrated Glove Manufacturing Complex”或“NGC”)中。该工厂的关闭预计将持续6个月,直到2023年年低。

根据声明,BB拥有4个生产工厂和40条生产线,目前产能为每年13.0 billion只,约占总产能的30.0%。可惜的是,由于技术陈旧, BB的运营效率低于NGC。据了解,NGC的每条生产线的年产量高达388.0 million 只,而BB的生产线产能则是325.0 million只。这导致了BB的能源、劳动力和维护成本更高。

接下来就让我们探讨HARTA最新季度业绩(Q4FY2023)的表现吧。

营业额比较(YoY -46.8%、QoQ +11.7%)

截至2023年3月31日,公司的营业额同比去年减少了约RM452.9 million或46.8%至RM515.7 million左右。这主要是由于手套的ASP和销量下滑。此外,公司继续面临市场供应过剩、客户调整库存等不利因素。

然而,与上个季度相比,该公司本季度的营收增加了约RM53.9 million或11.7%。这是由于手套销量增加。

税后盈利比较(YoY -52.9%、QoQ -848.7%)

由于手套的销量和ASP齐跌,该公司的净亏损进一步恶化,从去年同期的约RM197.9 million扩大至RM302.7 million左右。这是因为公司在本季度有一笔RM347.0 million的一次性资产减值亏损,而这项减值亏损是因BB工厂停用所致。

除了生产利用率下降,能源成本和劳动成本的增加也导致了公司的净亏损环比增加了848.7%左右。

前景展望

全球医疗手套市场仍面临着严峻的挑战。在疫情期间,手套行业的产能不断扩大,大量库存积累,导致市场供需失衡。此外,手套行业还面临着能源、劳动等成本上涨的压力。因此,该公司预计在即将来临的2024财政年度将有另一项一次性支出,即约RM70.0 million的裁员成本和合同义务费用。

鉴于这种充满挑战的形势,HARTA启动了一项五年战略计划。这包括上述通过关闭其 BB 工厂和将业务集中在 NGC 来使运营合理化的行动。管理层表示,此举可降低营运成本,进而提升公司整体竞争力。

综上所述,虽然HARTA本季净亏损持续扩大,但仍持有约RM1,724.4 million的巨额现金。这将使公司继续朝着创新和自动化(“Innovation & Automation”)方向发展,成为走在行业前沿的技术型手套公司。

|

|  05 May 2023, 9:27:33 PM 05 May 2023, 9:27:33 PM

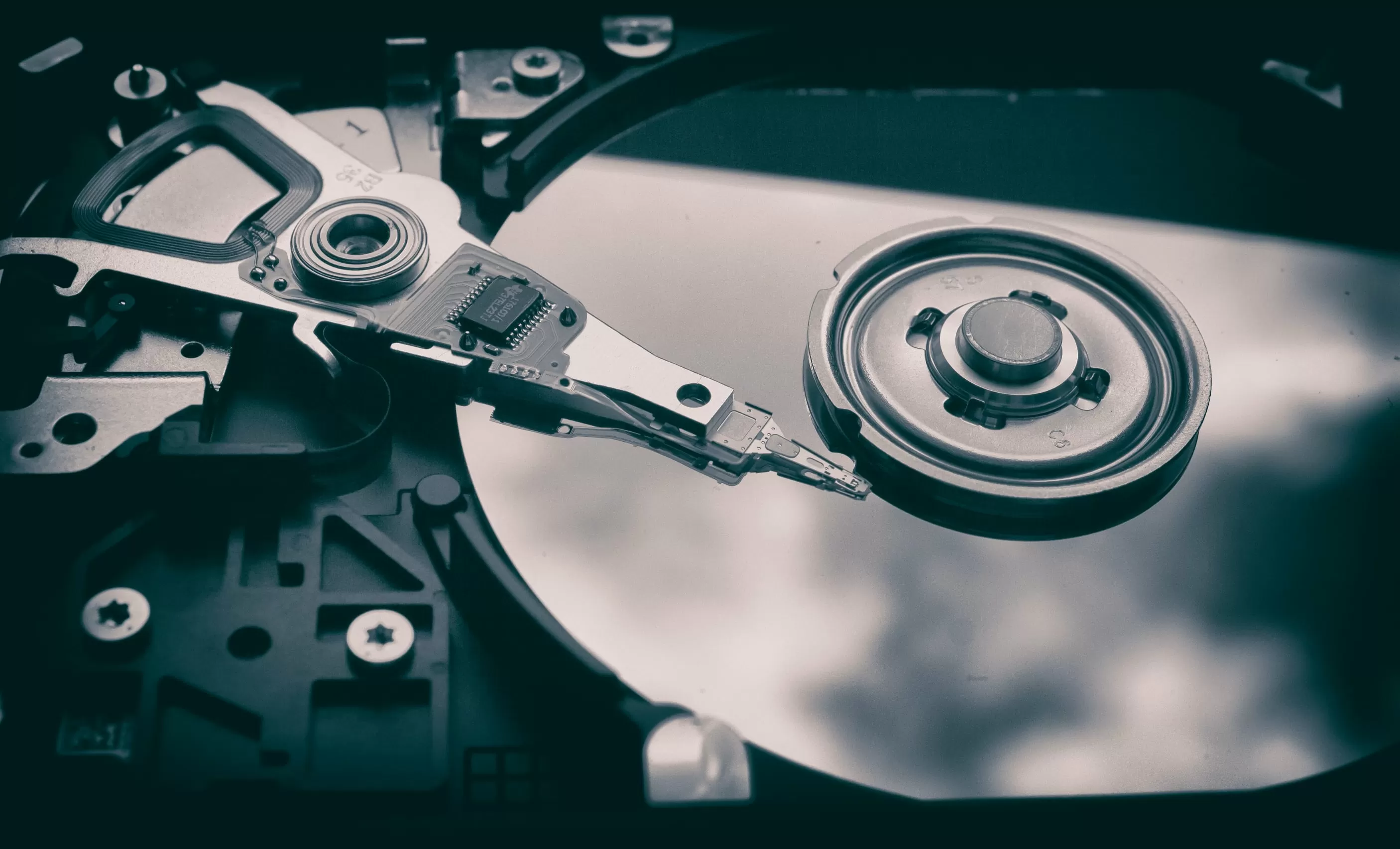

As the digital economy rapidly develops, the demand for high-capacity, high-speed, and high-quality storage devices continues to rise. Therefore, the Hard Disk Drive (HDD) industry remains an important component of the digital storage sector.

For the information, the HDD is a data storage device consisting of magnetic disks, read/write heads, and other components. HDDs are mainly used in personal computers, servers, digital video recorders, game consoles, and mobile devices. In addition, HDDs also have broad application prospects in big data storage, cloud computing, and other fields. Currently, the major participants in the HDD market include Seagate, Western Digital, Toshiba, and Hitachi Global Storage Technologies.

However, due to sluggish demand, inventory reduction, and the popularity and technological advances of Solid-State Drives (SSDs), the HDD industry is facing a downward trend. Just a few days ago, Dufu Technology Corp. Berhad (DUFU, 7233), which engages in the manufacturing and trading of HDD and other related components, reported weaker results.

Let's take a look at DUFU's latest quarterly performance (Q1FY2023).

Revenue Comparison (YoY -14.07%, QoQ +44.88%)

As of March 31, 2023, DUFU's revenue decreased by approximately RM12.15 million or 14.07% YoY to around RM74.18 million. This is mainly due to the decline in HDD business revenue. In fact, since the third quarter of the 2022 fiscal year, the company's revenue has been declining, as HDD demand has significantly decreased after the pandemic, and major enterprises have also adjusted their inventory and reduced orders.

The quarterly report shows that the company's business revenue in Malaysia, Singapore, and China all decreased year-on-year. Among them, Malaysia's business revenue decreased by 9.31% YoY to around RM69.29 million. Singapore and China's business revenue decreased by about 17.53% and 30.08% YoY, respectively, with revenue of approximately RM58.12 million and RM11.44 million recorded in this quarter.

However, compared to the previous quarter, the company's revenue increased by approximately RM22.98 million or 44.88%. This is due to the company's increased production volume in this quarter, which has led to an increase in revenue.

Net Profit Comparison (YoY -40.61%, QoQ +260.26%)

Due to the decrease in sales of HDD-related products and the rise in raw material costs, DUFU's net profit decreased by approximately RM7.44 million or 40.61% YoY to around RM10.88 million.

The company's pre-tax profit also fell from around RM23.74 million in the same period last year to around RM14.39 million. Among them, the business in China went from profit to loss, suffering a pre-tax loss of approximately RM0.34 million, reversing the profit performance of approximately RM0.92 million in the previous period.

Along with DUFU's high production volume in the first quarter, the company's fixed management expenses also decreased. Therefore, the company's pre-tax profit increased by approximately RM12.37 million or 611.97% QoQ.

It is worth mentioning that the company announced a final dividend of RM0.040 per share in this quarter, with an ex-date of May 29 and a payment date of June 16, 2023.

Outlook

Due to numerous uncertain factors in the first half of this year, the high inflation rates in the United States and European countries have led to a slowdown in consumer spending and a reduction in capital expenditures for businesses and cloud industries, which in turn has affected the demand for HDD. Therefore, due to the decrease in customer demand and the challenging operating environment, coupled with the unclear market conditions, the management expects a decline in performance for the next quarter.

In addition, large companies in the technology sector are undergoing a second round of layoffs, which means that the entire industry will face severe challenges in the coming quarters, especially in the data center and industrial terminal markets, highlighting weak demand.

On the cost side, although raw material costs have fallen from their peak, prices are still high. The increase in energy costs in Malaysia will also further impact the company's profitability.

Looking to the long-term, the demand for cloud data centers will continue to increase with the growth of digital storage devices, and HDD storage devices remain the most economical way to store large amounts of data. According to Storagenewsletter, the HDD market is expected to grow at a compound annual growth rate of 11.20% from 2022 to 2029.

So, what do readers think about DUFU, which is currently in a net cash position with a PE ratio of approximately 18.40x?

|

|  04 May 2023, 11:11:33 AM 04 May 2023, 11:11:33 AM

随着数字经济的迅速发展,人们对大容量、高速度和高质量存储设备的需求越来越高。因此,硬盘驱动器(“Hard Disk Drive”或“HDD” )行业仍然是数字存储领域的重要组成部分。

简单说明,HDD是一种存储数据的设备,由磁性盘片、读写磁头等零件组成。HDD主要应用于个人电脑、服务器、数码录像机、游戏机和移动设备等。此外,HDD在大数据存储、云计算等领域也有着广阔的应用前景。目前,HDD市场的主要参与者包括希捷(Seagate)、西部数据(Western Digital)、东芝(Toshiba)和日立环球储存科技(Hitachi Global Storage Technologies)等公司。

然而,由于需求低迷、企业去库存以及固态硬盘(“Solid-State Drive”或“SSD”)的普及和技术进步,HDD行业面临着下滑趋势。就在几天前,从事HDD和其他相关组件的制造和贸易的Dufu Technology Corp. Berhad (DUFU、7233)发布了较为逊色的成绩。

事不宜迟,就让我们来探讨DUFU最新季度(Q1FY2023)的业绩表现吧。

营业额比较(YoY -14.07%、QoQ +44.88%)

截至2023年3月31日,DUFU的营收同比去年减少约RM12.15 million或14.07% 至RM74.18 million左右。这主要是由于HDD的业务收入下降所致。事实上,从2022财年第三季度开始,公司的营收就呈现下滑形势,这是因为HDD的需求在疫情后大幅下滑,各大企业也纷纷调整库存以及减少订单。

从季报里可以看出,公司位于马来西亚、新加坡和中国的业务收入都按年下降。其中,马来西亚的业务收入按年下降9.31%至RM69.29 million左右。新加坡和中国的业务收入则按年下了约17.53%和30.08%,分别在本季度录得了约RM58.12 million和RM11.44 million的营收。

不过,与上个季度对比,公司的营业额增加了约RM22.98 million或44.88%。这是由于公司在本季度产量增加,使得营业收入上扬。

税后盈利比较(YoY -40.61%、QoQ +260.26%)

由于HDD相关产品的销量减少和原材料成本上涨,DUFU的净利润同比减少了约RM7.44 million或40.61%至RM10.88 million左右。

公司的税前利润也从去年同期的约RM23.74 million下跌至RM14.39 million左右。其中,中国的业务由盈转亏,蒙受约RM0.34 million的税前亏损,逆转前期约RM0.92 million的盈利表现。

伴随着DUFU在第一季度取得较高的生产量,公司的固定管理费用也有所减少。因此,公司的税前利润环比增加了约RM12.37 million或611.97%。

值得一提的是,公司在本季度中宣布派发 RM 0.040 的末期股息,除权日于5月29日,将于2023年6月16日支付。

前景展望

由于今年上半年仍存在诸多不确定因素,美国和欧洲国家的高通胀率导致消费放缓,企业和云端行业的资本支出也进一步减少,从而打击了HDD的需求。因此,由于客户需求下降,经营环境充满挑战,加上市场状况未明朗,管理层预计下个季度业绩会有所下滑。

此外,科技领域的大公司正在进行第二轮裁员,这意味着未来几个季度整个行业将面临严峻考验,尤其是数据中心和工业终端市场,将凸显需求疲软。

成本方面,虽然原材料成本已从峰值回落,但价格仍处于高位。马来西亚的能源成本提高也将进一步打击公司的盈利能力。

以长远来看,云端数据中心的需求将随着数字存储设备的增长而与日俱增,而HDD存储设备仍然是存储大量数据最经济的方式。据Storagenewsletter报道,HDD市场预计从2022年到2029年将以11.20%的复合年增长率增长。

那么,对于目前处于净现金状态、PE约为18.40倍的DUFU,各位读者怎么看呢?

|

|  02 May 2023, 5:21:42 PM 02 May 2023, 5:21:42 PM

The oil market is currently facing challenges, such as concerns about an economic recession leading to a drop in oil prices. At the same time, the development of renewable energy and increasing environmental awareness are also accelerating the transition of many countries and regions towards renewable energy.

However, with the increasing global economic activities, the demand for oil is expected to gradually increase. According to the report by Saudi Aramco, a state-owned oil company in Saudi Arabia, global oil demand is expected to reach around 140 million barrels per day by 2030. Furthermore, although renewable energy is developing rapidly, oil will still be one of the main sources of energy globally for the next few decades.

Today, I will be sharing about Dayang Enterprise Holdings Berhad (DAYANG, 5141), an oil and gas service provider with a strong order book.

First, let me briefly introduce this company.

DAYANG, which was founded in 1980, is a comprehensive oil and gas service provider based in Sarawak. The company's initial business was trading hardware materials and providing human resources to the offshore oil and gas industry. Over time, the company's business has expanded to maintenance services, fabrication, hook-up and commissioning, and marine vessel chartering. For the record, DAYANG successfully listed on the main board of Bursa Malaysia in 2008.

In terms of its corporate structure, DAYANG has a streamlined and clear organizational structure, with three wholly-owned subsidiaries operating its businesses: Dayang Enterprise Sdn Bhd (DESB), DESB Marine Services Sdn Bhd (DMSSB), and Fortune Triumph Sdn Bhd (FTSB).

According to the company's annual report, DESB is responsible for topside maintenance services, small-scale fabrication, offshore hook-up and commissioning; DMSSB owns marine vessels and is responsible for vessel chartering; FTSB provides equipment rental. Additionally, DAYANG holds a 63.69% stake in Perdana Petroleum Berhad (PERDANA, 7108), a listed oil and gas company that mainly provides offshore support services to the oil and gas industry.

Based on the 2022 annual report, DAYANG's main revenue comes from topside maintenance services (TMS), which accounted for around 64.51% of the total revenue in the fiscal year 2022. The next largest contributor was integrated hook-up and commissioning (IHUC) services, contributing approximately 20.75% of the revenue, followed by marine vessel chartering (Marine Charter), which contributed about 14.75% of the revenue.

Regarding its financial situation, as of the end of 2022, DAYANG's total assets were RM2,361.77 million, revenue was RM984.18 million, and net profit was RM124.24 million. Compared to the low base in 2021, the company's revenue and net profit increased by 47.39% and 138.96%, respectively, and the company successfully turned a profit for the full year. This was mainly due to the economic recovery and rising oil prices, as well as increased contract orders from oil giants. The annual vessel utilization rate also increased from 44.00% in 2021 to around 60.00%.

On the other hand, the company's cash flow was stable, and its debt gradually decreased. In addition, the company's annual dividend for the fiscal year 2022 was as high as RM0.030, to reward its shareholders.

Looking to the future, with the recovery of Malaysia and international economic activities, the company is expected to win more new tenders for maintenance, construction, modification, and hook-up and commissioning. The management expects customers to increase their capital expenditure for maintenance for the sake of increasing the production and productivity of crude oil and natural gas.

It’s worth mentioning that DAYANG has a robust order book. As of December 2022, the company held approximately RM1,400.00 million worth of contract orders. In addition to a recent contract awarded by Petronas Carigali, the company also secured four Accommodation Work Boat* (AWB) contracts in February and March of this year. Hence, DAYANG has secured five AWB contracts this year. However, the company has not disclosed the overall contract value as they are on a demand basis and subject to requirements.

*An Accommodation Work Boat is a vessel specifically designed to provide accommodation and workspace for crew and staff. These boats are typically equipped with necessary equipment and facilities to ensure adequate comfort and safety for personnel during offshore tasks such as underwater maintenance, oil and gas exploration, and offshore construction

According to the survey, the daily charter rate (DCR) now ranges from RM70,000.00 to RM90,000.00. Compared with the DCR of RM50,000.00 to RM70,000.00 a year ago, the price has risen. As a result, DAYANG is anticipated to continue to perform well in the future.

Considering DAYANG's current Price to Earnings (PE) ratio of only about 12.30 times, how do readers view the company's prospects?

|

|  01 May 2023, 5:34:46 PM 01 May 2023, 5:34:46 PM

石油市场的前景目前面临挑战,例如经济衰退的担忧导致石油价格下跌。同时,可再生能源的发展和环保意识的增强也加速了许多国家和地区向可再生能源的转型。

尽管石油市场面临着挑战,但随着全球经济活动日增月盛,石油需求有望逐渐增加。根据沙特阿拉伯国有的阿美石油公司(“Saudi Aramco”)的报告,预计到2030年全球石油需求将达到每天1.40亿桶左右。此外,虽然可再生能源的发展迅速,但在未来几十年内,石油仍将是全球主要的能源来源之一。

今天要与各位读者分享的是一家订单强劲的油气服务供应商Dayang Enterprise Holdings Berhad (DAYANG、5141)。

首先简单介绍一下DAYANG这家公司。

DAYANG创立于1980年,是一家位于砂劳越的综合油气服务供应商。该公司最初的业务是贸易硬件材料并为海上石油和天然气行业提供人力资源。随着时间的推移,该公司的业务已扩展到包括维护服务、制造操作、连接和调试以及海运船舶租赁。此外,DAYANG也于2008年成功在马来西亚交易所的主板上市。

以企业结构来说,DAYANG 拥有精简清晰的组织架构,由旗下三家全资子公司来营运公司的业务,分别是 Dayang Enterprise Sdn Bhd(DESB)、DESB Marine Services Sdn Bhd(DMSSB)及Fortune Triumph Sdn Bhd(FTSB)。

根据公司年报显示,DESB负责海上装置维护服务、小型制造业务、海上联锁和调试;DMSSB是海洋船舶的所有者,负责租赁船舶;FTSB提供租赁设备。

另外,DAYANG还持有一家上市油气公司Perdana Petroleum Berhad(PERDANA、7108)约63.69%的股权。PERDANA主要是为石油和天然气行业提供离岸支持服务。

从2022年的年报来看,DAYANG的主要业务收入来自海上装置维护服务(“Topside Maintenance Services”或“TMS”)业务,占据了2022财年总营业额的64.51%左右。其次是集成连接和调试(“Integrated Hook-Up and Commissioning“或“IHUC)业务,贡献了约20.75%的营业收入。接下来则是来自海洋船舶租赁(”Charter of Marine Vessels“或”Marine Charter“)业务,贡献了约14.75%的营业额。

财务状况方面,截至2022年底,DAYANG的总资产为RM2,361.77 million,营业收入为RM984.18 million,净利润为RM124.24 million。与2021年的低基数相比,公司的营业收入和净利润分别增涨47.39%和138.96%,全年也成功扭亏为盈。这主要是由于经济复苏和油价上涨,以及来自石油巨头的合同订单增加。全年的船只使用率也从2021年的44.00%上升至60.00%左右。

另一方面,公司的现金流稳定,而债务也逐步减少。此外,公司2022财年的年度股息也高达RM0.030,以回馈股东。

展望未来,随着马来西亚和国际经济活动的复苏,公司有望获得更多维护、建设、改造以及连接和调试的新招标。管理层预计客户将增加维护方面的资本支出,以提高原油和天然气的产量及生产率。

值得一提的是,DAYANG的订单量十分强劲。截至2022年12月,公司持有约RM1,400.00 million的合约订单。此外,除了最近从Petronas Carigali获得的合约外,该公司还在今年2月和3月赢得了总共4项住宿工作船*(“Accommodation Work Boat”或“AWB”)合同。 可以看出,DAYANG今年以来已经拿下了5份AWB合同。 不过,该公司并未给出整体合同价值。 这是因为其合约是按需的性质,视需求而定。

*住宿工作船是一种专门设计用于提供工作人员和船员住宿和工作场所的船只。通常,这种船配备了必要的设备和设施,以确保工作人员和船员在离岸任务期间得到足够的舒适和安全保障。住宿工作船可用于各种任务,如水下维修、石油和天然气开采、海上建筑等等

据调查,每日租船费率(“Daily Charter Rates”或“DCR”)现在介于RM70,000.00至RM90,000.00,与一年前的RM50,000.00至RM70,000.00的DCR相比,价格有所上涨。因此,未来DAYANG将继续交出好成绩。

那么,读者如何看待目前市盈率(“PE”)仅为12.30倍左右的DAYANG呢?

|

|  30 Apr 2023, 12:09:28 PM 30 Apr 2023, 12:09:28 PM

As per the forecast by the Malaysian Rubber Glove Manufacturers Association (MARGMA), the global demand for gloves is anticipated to return to pre-pandemic levels in 2023, which amounts to around 280-340 billion pieces. In response to China's increased average selling price (ASP) for gloves, Malaysian glove manufacturers have made the necessary adjustments as well, which are raising the ASP from USD 17.00 per 1,000 pieces to roughly USD 21.00. Consequently, glove manufacturers' stock prices have recently shown a positive trend.

Notwithstanding, Kossan Rubber Industries Berhad (KOSSAN, 7153), one of Malaysia's largest rubber glove manufacturers, has reported unexpected results recently, with its revenue continuing to decline and net losses widening. This development has caused the temporary halt of the upward trend of glove stocks.

Before exploring KOSSAN's latest quarterly performance, let's briefly review the company's background.

KOSSAN was established in 1979 and headquartered in Selangor, Malaysia. KOSSAN has become one of the world's largest disposable glove manufacturers and one of Malaysia's largest technical rubber product manufacturers since its listing on the Malaysian Stock Exchange in 1996.

According to the 2020 annual report, KOSSAN has 23 factories with an annual production capacity of 33.5 billion gloves. The company's revenue comes from three categories: gloves, technical rubber products, and cleanroom products such as gloves, masks, and wipes, primarily used in the electronics and electrical industry.

Most of the company's gloves are sold to foreign markets such as North America, Europe, and Asia-Pacific and have been exported to more than 90 countries nowadays. According to the 2022 annual report, approximately 89.92% of the revenue came from foreign markets, while Malaysia's market share was only around 6.71%.

Now, let's look into KOSSAN's just-released quarterly report.

Revenue Comparison (YoY -42.85%, QoQ -18.02%)

As of March 31, 2023, the company's revenue decreased by approximately RM295.92 million YoY, recording only around RM394.71 million due to intense market competition and declining global glove demand as the pandemic eased.

Based on the news reports, the current average selling price of Chinese gloves is only USD 17.00 per 1,000 pieces, which is lower than Malaysia's gloves at around USD 21.00 per 1,000 pieces. Therefore, it is believed that some orders may have shifted to China.

Among the RM394.71 million in revenue, around RM317.54 million came from glove business, recording a decrease of around 47.91% compared with the same period last year. The sales of cleanroom products also decreased by approximately 26.06% YoY to around RM21.02 million. However, the sales of technical rubber products increased by around 13.86% YoY, achieving RM56.13 million.

Owing to lower average selling prices and sales volume, the company's revenue decreased by around RM86.74 million or 18.02% QoQ.

Net Profit Comparison (YoY -126.91%, QoQ -873.90%)

KOSSAN was evidently impacted by the decrease in glove ASP and sales volume, with a net profit of RM90.10 million for the same period last year turning into a net loss of RM24.25 million. This is due to rising energy costs and employee costs, coupled with increased overall operating costs resulting from lower factory utilization.

Additionally, the performance for the first quarter of the 2023 fiscal year was affected by rising natural gas and electricity prices. As a result, the company's losses continued to widen during the quarter.

Outlook

The glove industry will continue to face unfavorable factors such as rising energy prices and employee costs in 2023. Therefore, the management has indicated that the company will temporarily suspend its recent expansion plans based on the current market conditions.

However, with the recovery of global economic activity and the growth of infrastructure construction, it is expected that the sales volume of the company's technical rubber products will gradually increase.

It is worth mentioning that although the net loss continues to expand, the company holds a huge cash balance of approximately RM1.07 billion, which positively enables KOSSAN to overcome the challenges of the inventory cycle.

|

|  29 Apr 2023, 9:09:48 AM 29 Apr 2023, 9:09:48 AM

根据马来西亚橡胶手套制造商协会(MARGMA)预测,全球手套需求将在2023年恢复疫情前的水平,也就是介于2,800亿只到3,400亿只之间。马来西亚手套制造商也随着中国对手套平均售价(“Average Selling Price”简称“ASP”)的上涨做出调整,即从每1,000只USD 17.00的ASP提高至 USD 21.00左右。因此,近期手套制造公司的股价都呈现上扬趋势。

然而,马来西亚最大的橡胶手套制造公司之一的Kossan Rubber Industries Berhad (KOSSAN、7153)昨天发布了出乎意料的成绩;营业额继续下滑,净亏损扩大。随之,手套股的上升趋势也暂告一段落。

在探讨KOSSAN最新的季度业绩(Q1FY2023) 之前,就来简要了解一下公司的背景。

KOSSAN创立于1979,总部位于雪兰莪巴生。自 1996 年在马来西亚交易所上市以来,KOSSAN 已发展成为世界最大的一次性手套制造商之一,也是马来西亚最大的技术橡胶产品制造商之一。

从2020年的年报来看,KOSSAN拥有23家工厂,而年产能达到335 亿 只手套。公司的业务收入都来自三类;其中占比最高的是手套业务,其次是工业用的技术橡胶产品(“Technical Rubber Products)。最后是洁净室产品(”Cleanroom Products”),例如洁净室手套、口罩和湿巾等,而这些产品主要用于电子电气行业。

公司手套大部分都销售到北美、欧洲、亚太等外国市场,现已出口到90多个国家。从2022年的年报显示,约89.92%的营业额都来自国外市场,而马来西亚市场仅占6.71%左右。

接下来就来解读KOSSAN刚发布的季报吧。

营业额比较(YoY -42.85%、QoQ -18.02%)

截至2023年3月31日,公司的收入同比去年减少了约RM295.92 million, 仅获得了RM394.71 million左右。这是由于市场竞争激烈以及手套的需求也随着全球疫情的缓解日削月朘。

据了解,目前中国手套的平均售价仅为每1000只USD 17.00 (约RM75.87),低于马来西亚手套制造商的USD 21.00(约RM93.72)。因此,个人认为部分的订单是流向中国的。

在RM394.71 million的营业额中,约RM317.54 million是来自手套业务,较去年同期下降了47.91%左右。洁净室产品的销量也同比下滑了约26.06%,至RM21.02 million左右。不过,技术橡胶产品的销量则同比增加了约13.86%,获得了RM56.13 million。

在平均售价和销量较低的情况下,公司的营业收入环比减少了约RM86.74 million或18.02%。

税后盈利比较(YoY -126.91%、QoQ -873.90%)

KOSSAN明显受到手套ASP 及销量下降的影响,公司从去年同期的净利RM90.10 million转为净亏损RM24.25 million。这是由于能源成本和员工成本上升,加上较低工厂使用率导致整体的营运成本增加。

此外,2023财年第一季的业绩也受到天然气和电价上涨的影响,导致公司的亏损高于上个季度的RM2.49 million。

前景展望

手套行业在2023年仍面临能源价格和员工成本上涨的不利因素,因此管理层表示,公司将根据当前市场状况暂停其近期扩张计划。

然而,随着全球经济活动的复苏和基础设施建设的增长,预计公司技术橡胶产品的销量将逐渐增加。

值得一提的是,虽然净亏损持续扩大,但公司持有约RM1,075.38 million的巨额现金,足以确保KOSSAN能够渡过去库存周期的挑战。

|

|

|

|